Economics

12 articles tagged "Economics"

-

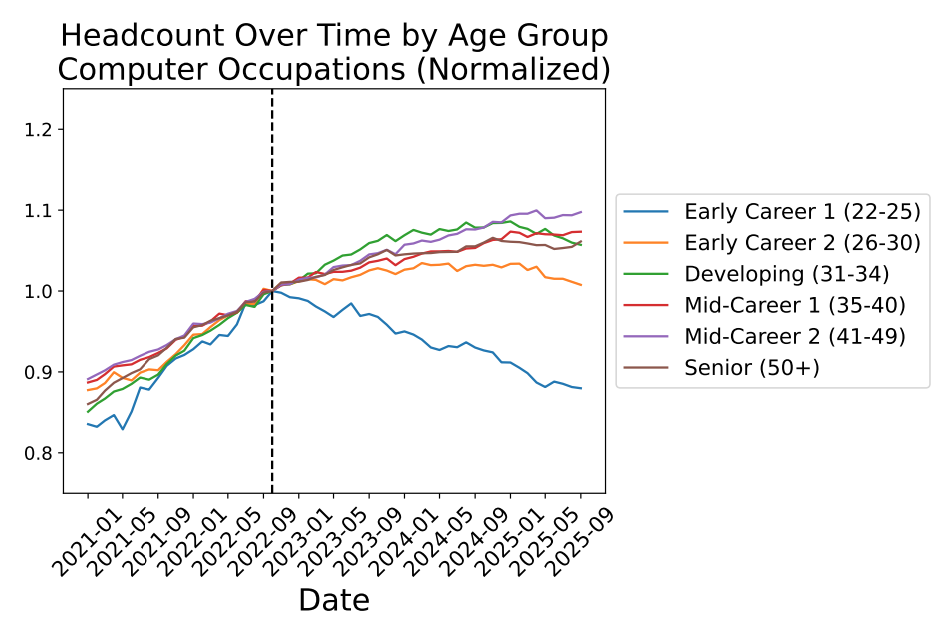

The Kids Will Be Alright

Continue reading →We’ve all heard it: AI is coming for junior-level jobs. If you are in your 20s and you use a computer for work, you have already been affected . Plenty of handwringing ensued . But fear not, it is an illusion.…

-

Capital Is No Longer King

Continue reading →Why the Fed Raised Rates - The New York Times

The Federal Reserve is ready to party like it’s 1988.

The rest of us are eying a labor-force participation rate that is lower than it has ever been through the 80s and the 90s (a period that included 3 recessions). The share of part-time employment is still higher than before the Great Recession. Even full-time employment now rarely includes such economic stabilizers as defined-benefit pensions or comprehensive healthcare coverage. This might be why all those jobs Yellen is celebrating don’t seem to be doing a thing to inflation, which has remained well below the Fed’s own target of 2% for most of the last 10 years. But wow, 4.3% unemployment! It’s enough to make us all feel young again!…

-

Stealing from the Future

Continue reading →Western Nations Worry That Children Won’t Be Better Off

The 2006 movie Children of Men (based on a novel of the same title) explores a dystopian future in which an 18-year pandemic of infertility leaves the planet entirely child-less. The film’s premise of social breakdown goes unchallenged since we intuit humanity as a kind of pyramid scheme. The next generation is synonymous with a people who are smarter, healthier, longer-lived, more diverse, and more tolerant than the lot in which we find ourselves today. Whether or not we assume the future will have more people, we all presume that the future will have better people.…

-

Make Things

Continue reading →The appeal to a golden era “when we used to make things” isn’t just nostalgia or judgmentalism. It refers to a qualitative but real difference between building vs. taking. Building things imposes a certain rigor not only on our thinking but also our values. When we build we are advancing the aggregate capability of humanity in some small way. We don’t all have to be sending people to Mars, we can also build by working out the inner mechanisms of some new gadget that others will find useful or putting together a cake others will find delicious. When we take, we are instead simply shifting around the spoils of such efforts from others to ourselves by, say, helping ourselves to their savings by opening fake bank accounts.…

-

The Design of Nations

Continue reading →Rose thou art sick - The Economist

The central thesis of the center-left has always been that government is the home for exactly those values that are not naturally served by markets, that two such kinds of values can and do exist, that it is legitimate to want for your country “soft” attributes like openness, fairness and civility alongside (and perhaps even at the partial expense of) “hard” attributes like economic growth and military power.…

-

Too Much Money

Continue reading →In the Bizarro World of Negative Interest Rates, Saving Will Cost You - The New York Times

Is it possible we’ve created more money than we know what to do with?…

-

Who exactly needs to rise to the occasion?

Continue reading →Report Suggests Nearly Half of U.S. Jobs Are Vulnerable to Computerization - MIT Technology Review

In my consulting days, I espoused an unpopular theory, that 40-60% of the workforce of every Fortune 500 company could be replaced with a well-programmed computer. I was often met with incredulity and admonished that even if such a future were inevitable, it was surely not a topic for polite conversation.…

-

A Trillion Better Spent

Continue reading →The Perpetual Bubble Economy - The New York Times

Wealth is the present value of expected cash flows at some discount rate. If you reduce those cash flows by single-handedly reducing economy-wide spending (as the government can do), then the only way to prop up wealth is to drive down the discount rate with which it is computed. This causes wart-like inflations in the prices of long-term assets (e.g. housing), and distortions away from real production (since no one is buying stuff) towards financial intermediation (since you have to go to greater lengths to get any return on your savings).…

-

Risk Rolls Downhill

Continue reading →Wealth Inequality in America - YouTube

People think linearly, though income and wealth accrue geometrically. The differences are enormous, especially over time.

Those who spend all that they earn (or more) are not accumulating the wealth needed to buffer themselves from the vicissitudes of a capital economy. As a result, they accept increasingly poorer deals (can’t afford to be without a job due to the need for health insurance, can’t afford to retrain, relocate, or just relax…). This decreased bargaining power further diminishes their (and their children’s) ability to build wealth, and the cycle continues.…

-

Wages Are Demand

Continue reading →The law of demand is a bummer - The Economist

Opening with a straw man, the Economist claims that raising the minimum wage requires that we forsake the law of demand: that “raising the price of something–low-skilled labor, in this case– will reduce demand for that thing.”…

-

When Money Begs to Be Spent

Continue reading →Japan Steps Out - The New York Times

We forget that money is a good just like any other. Saying that no one wants to buy things (GDP being the rate of such purchases) is the same as saying people would rather keep the money (or, equivalently, pay down debt). As a result, there is an exorbitant demand for money. Similarly, when long-term government interest rates (for a nation that can print its own currency no less) remain depressed in the face of a recession, there is clearly an exorbitant demand for government debt. The two come together in the fact that real long-term rates on US Treasury securities remain negative on maturities out to 2029; the global markets are paying the US government to spend their money for them, to the tune of trillions of dollars .…

-

Idle Wealth

Continue reading →To Reduce Inequality, Tax Wealth, Not Income - The New York Times

An economy, like a business, has a (cross-sectional) balance sheet and income statement. In times of inflationary growth, you want to transfer activity from the income statement to the balance sheet, slowing down spending and increasing saving. So you tax income and provide tax breaks for things like retirement accounts.…